oregon tax payment deadline

The Oregon Department of Revenue announced late Wednesday March 25 2020 that the state of Oregon will officially extend the deadline for certain tax payments until July 15 2020. 2021 trust and estate returns and payments.

The 2021 tax deadline to file City of Oregon returns is April 18 2022.

. Annual Use Fuel User - Annual tax less than 10000 as authorized by the department. 3 2022 can expect a payment. The April 18 deadline to file state and federal personal income tax returns is ten days away and DOR estimates it will receive a few hundred thousand more returns by then.

You will receive your payment by direct deposit or check. The tax year 2019 six-month extension to file if requested continues to extend only the filing deadline until October 15 2020. Taxpayers that have substantial nexus with Oregon must pay taxes on their Oregon commercial activity.

The Oregon tax payment deadline for payments due with the 2019 tax year return is automatically extended to July 15 2020. As a service to our citizens payments can be made by credit card. 1 day agoChild tax credit worth 750 have quickly approaching deadline 43 million residents that filed their 2020 taxes before Jan.

What are the specific Oregon tax returns for which filing deadlines have been postponed to May 17 2021. What are the specific Oregon tax returns for which filing deadlines have been extended to May 17 2021. Skip to the main content of the page.

2021 TriMet and Lane Transit District self. You will automatically avoid interest and penalties on the taxes paid by July 15. During Wednesday mornings conference call with the media Governor Kate Brown said personal filing deadlines will be extended until July 15.

In most cases you must file and pay your taxes by July 15. Form OR-40 OR-40-N and OR-40-P Oregon Personal Income Tax Returns Form OR-STI. This includes payment of your 2021 tax liability.

Oregon Corporate Activity Tax payment deadline July 31 2020. What do I need to do to get a payment. That will give them until Oct.

The IRS and Oregon changed the tax filing and payment deadline from April 15 to May 17. Commercial activity generally means a persons or unitary groups total amount realized from. Reports must be received by the department on or before January 20 for each year.

Estimated tax payments for tax year 2020 are not extended. When are 2020 taxes due. If you need assistance with the preparation of your return visit the Taxpayer Assistance page.

2022 first quarter individual estimated tax payments. Therefore the director has issued Directors Or der 2021-01 ordering an automatic postponement of the 2020 tax year filing and payment dates for individual Oregon taxpayers to May 17 2021. Penalties and interest will begin to accrue on any remaining unpaid balances as of July 16 2020.

How can I find out if I received the Oregon Earned Income Tax Credit. The Oregon Department of Revenue DOR intends to follow guidance from the IRS when more details become available. 4th 10-1 to 12-31 January 20.

Learn more about marijuana tax requirements. Photo Metro Creative Connections. Individual taxpayers can also postpone state income tax payments for the 2020 tax year due on April 15 to May 17 without penalties and interest regardless of the amount owed.

Form OR-40 OR-40-N and. Payments can be made by choosing the. But any quarterly payments for 2020 still will be due April 15.

If you filed your 2020 tax return by December 31 2021 and received EITC you dont need to do anything. Tax filing and payment due dates for individuals from April 15 2021 to May 17 2021. The Oregon tax payment deadline for payments due with the 2019 tax year return is automatically extended to July 15 2020.

3rd 7-1 to 9-30 October 20. Oregon Department of Revenue. Taxpayers must make their second payment for Oregons new Corporate Activity Tax CAT by July 31 2020.

The tax year 2019 six-month extension to file if requested continues to extend only the filing deadline until October 15 2020. Instructions for personal income and business tax tax forms payment options and tax account look up. Senior and disabled property tax deferral applications.

SALEM Oregonians now have until July 15 to file and pay their 2019 state personal or business income taxes. SALEM Ore - Oregons Department of Revenue DOR says as tax seasons deadline approaches many Oregonians still need to file tax returns. Call at least 48 hours in advance 503 945-8050.

This relief also includes estimated tax payments for tax year 2020 that are due on April 15 2020. 2021 individual income tax returns and balance-due payments. Cash payments must be made at our Salem headquarters located at.

Oregon has joined the Internal Revenue Service IRS in postponing the tax filing and payment due dates for individuals from April 15 2021 to May 17 2021. April 18 2022. Governor Eric Holcolmb has also approved a measure that would send 350 more to each eligible resident and 700 for married residents.

On Wednesday March 25 Governor Kate Brown announced that tax payment deadlines and personal filing deadlines for Oregon would also be delayed until July 15 2020. 2021 statewide transit individual tax returns and balance-due payments. This automatic Oregon tax filing and payment deadlines extension incorporates some but not all of the elements of the federal income tax filing and payment deadlines extension.

Taxpayers who need more time can request an extension on the IRS website. Individual taxpayers including those who pay self-employment tax can also postpone state income tax payments due on their 2020 tax year return until May 17 2021 according to a release from the Oregon Revenue Department. Income tax deadline has been moved from April 15 to May 17.

The Oregon Department of Revenue released more. Estimated tax payments for tax year 2020 are not extended. Last week the IRS delayed tax filing and tax payment deadlines to July 15 without interest or penalties.

Everything you need to file and pay your Oregon taxes.

Date Finder Rotating Calendar Calculator 5 Pack Amazon Ca Office Products

Filing An Oregon State Tax Return Things To Know Credit Karma Tax

Where S My Refund Oregon H R Block

Some Oregon Taxpayers Face Longer Waits For Refunds

List Of State Income Tax Deadlines For 2022 Cpa Practice Advisor

Where S My Kentucky State Tax Refund Taxact Blog Tax Refund State Tax Kentucky State

E File Oregon Taxes For A Fast Tax Refund E File Com

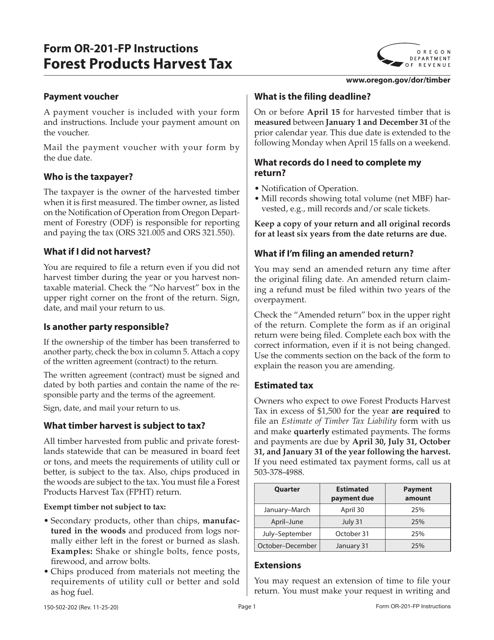

Download Instructions For Form Or 201 Fp Forest Products Harvest Tax Pdf Templateroller

Oregon State Tax Software Preparation And E File On Freetaxusa

.png)

Columbia County Oregon Official Website Understanding Your Property Tax Statement

Oregon Man Finds Year Old 1 Million Lotto Ticket Eight Days Before Deadline Bilet Fakty Mir

Blog Oregon Restaurant Lodging Association

Prepare Your Oregon State And Irs Income Taxes Now On Efile Com